Are you looking to invest in the steel industry? Understanding the current price of US steel stock is crucial for making informed decisions. In this article, we'll delve into the factors influencing the price of US steel stocks and provide insights into the current market trends.

Understanding the US Steel Industry

The US steel industry has been a vital part of the country's economy for over a century. It plays a significant role in the construction, automotive, and manufacturing sectors. The industry has faced numerous challenges over the years, including globalization, trade wars, and environmental regulations. However, it has also seen periods of growth and profitability.

Factors Influencing Steel Stock Prices

Several factors can influence the price of US steel stocks. Here are some of the key factors to consider:

Supply and Demand: The basic principle of supply and demand applies to the steel industry. An increase in demand for steel products can drive up stock prices, while a decrease in demand can lead to a decline in prices.

Raw Material Prices: The cost of raw materials, such as iron ore and coal, plays a significant role in determining steel prices. Fluctuations in raw material prices can directly impact the profitability of steel companies.

Trade Policies: Trade policies, such as tariffs and import quotas, can have a significant impact on the steel industry. Tariffs can increase the cost of imported steel, leading to higher prices for domestic steel products.

Economic Conditions: The overall economic conditions, including GDP growth, inflation, and employment rates, can influence the demand for steel products.

Company Performance: The financial performance of individual steel companies, including revenue, earnings, and debt levels, can also impact stock prices.

Current Market Trends

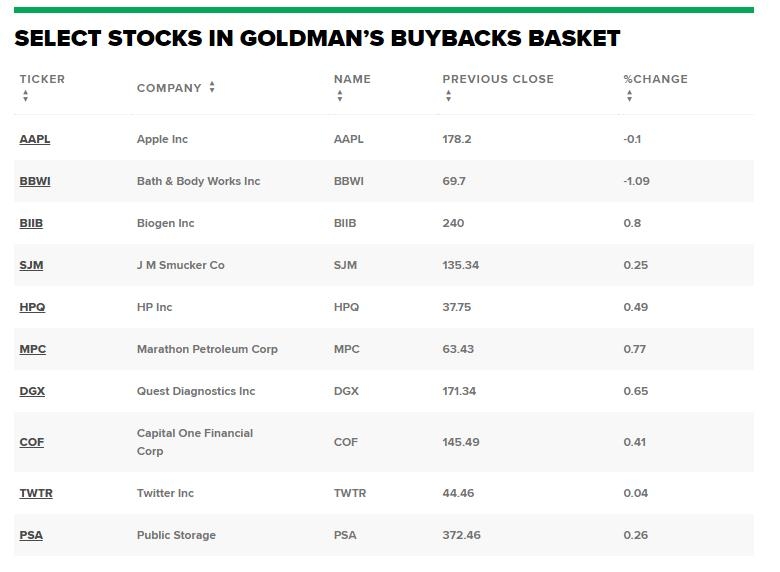

As of the latest data, the current price of US steel stocks is as follows:

These prices are subject to change based on the factors mentioned earlier.

Case Study: The Impact of Tariffs on Steel Stock Prices

In 2018, the Trump administration imposed tariffs on steel imports, aiming to protect the domestic steel industry. This move had a significant impact on steel stock prices.

This case study highlights the impact of trade policies on steel stock prices.

Conclusion

Understanding the current price of US steel stocks is essential for investors looking to invest in the industry. By considering the factors influencing stock prices and staying updated on market trends, investors can make informed decisions. Keep in mind that the steel industry is subject to various risks and uncertainties, so it's crucial to conduct thorough research before investing.

nasdaq composite